Trading

The journey to become a great trader is fraught with tears, losses, and many lessons to be learned. It takes a lot of time and practice to improve in trading, but there are some pitfalls you can sidestep. Here are some mistakes to avoid to become a great trader.

Using your money right away to trade.

Start with a demo trading account. Get used to how the market functions and try out trading in a virtual environment. Even if you’ve already started trading with your own money, a demo account is useful if you want to try scripted trading, new strategies based on new knowledge on technical or fundamental analysis, or to try out hedging techniques. A demo account is where you can test yourself before and during using real money.

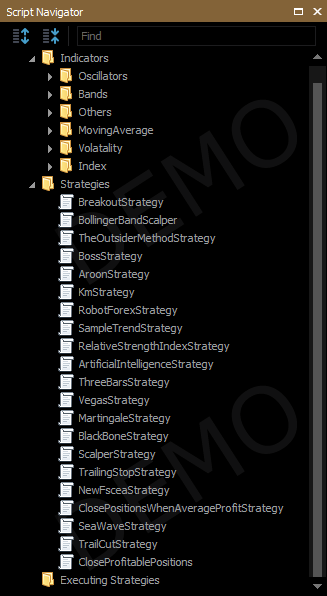

Ax1 demo offers a plethora of readymade automated strategies.

Letting your emotions get involved.

Never let your emotions to cloud your judgements in trading. The market is supremely unforgiving, and any mistake made while in an emotional mindset will make you feel even worse for having made that mistake. Keep a calm and level mindset when you’re trading.

Using high leverage without any reason.

Leverage is a double-edged sword. It can make your profits gigantic, but also make your losses huge. Every brokerage firm will offer huge leverage, but using that leverage is not always an obligation. Start with lower leverage, so even if you have a loss, it’s a smaller loss compared to if you had a larger leverage. Manage your expectations around leverage if you want to use higher leverage and keep yourself in check. Have some rules around placing trades with higher leverage, for example, setting tighter stop losses.

Missing massive opportunities.

Some dates or events that occur will create an impact on the market.. For example: political elections, declarations of war or peace, etc. In these cases, day traders have access to opportunities that longer-term traders do not. Look at the pictures below for GBPUSD. On October 29th, Brexit was announced to be delayed from October 31st to January 2020. There was a clear and measurable impact on the market in the day’s trading. But from a week’s perspective, it looks like any other day of trading. Missing such opportunities is dreadful from a trading perspective. A volatile day can boost your profits with proper risk management.

Brexit delay announcement 1hr indicator showing volatility.

Brexit delay announcement 1 day indicator, showing barely a blip in the bigger picture.

Having no plan while trading.

You must formulate a plan when you want to trade. It includes risk management, how many lots you will trade, when you will cut the trade if it goes into loss, and even other factors like how much time you will spend trading. Maintain a healthy relationship with trading. the market is always moving even if you are in front of the screen or not. Don’t worry about your trades if you’ve managed your risk appropriately. However, realize that no matter how good your plan is, the market is not so predictable. Even if you take 10 losses in a row from sticking to your trading plan, it doesn’t mean you should change it necessarily. Check why those losses happened and whether it was truly a failure of your trading plan or some other factor. It can be worth sticking to your trading plan if you really have confidence in it. 10 losses in a row can average out to a 40% loss over 100 trades, so always keep the bigger picture in mind. Don’t focus on the impact of a single trade.

Not managing your risk.

Forex trading has changed a lot since the days when people would shout out their orders in a trading pit to their brokers. Now you can do the entire process online while setting stop losses or taking limit orders, etc. Learn about the available options. A mistake that almost every beginner makes is not knowing when to stop the loss. Before you touch the ‘confirm’ button for a trade, determine how much risk you are willing to take on the trade. Even when you do take a loss, learn from the loss.

Placing too many trades and over-trading.

Do not take many trades. The quality of the trade matters more than the quantity of the trades. If you are a beginner, start with just a single trade. Analyze your emotions, and whether the trade goes positive or negative, remember to keep calm. The best thing you can do once you place a trade with risk management is to leave it as it is. Do not touch your trade after its been placed, because you risk more in doubting your original decision than if you trust yourself.

Choosing a bad firm to trade with.

Choose a regulated brokerage firm. From your perspective, there will be two main concerns once you’ve decided to open a trading account. Whether your trades will be fulfilled instantly, and whether you will get your money back when you request for it. Both unregulated and regulated brokers provide trading services, but as a regulated broker has to go through stringent qualifications, it is a much safer choice. However, for an unregulated brokerage firm, you may lose all the money you put with them the moment you deposited it, and you have practically no options. As trading is done over the internet now, choose the best online forex trading broker you can find. The willingness to pay for the security of your money and the services provided is up to you.

A trading pit

Mistakes in view of today’s reality

As said above, the world is not the same as it once was. Today there are thousands of free resources to use online to learn about trading and get training. In the end, a brokerage firm that offers training for its clients is reliable because it is 1 on 1, and you can ask any questions you have then and there. Trading is a different kind of activity than it used to be. With all the technology and safeguards that Alfa provides, most of these mistakes are not worth worrying about as these are things that we have already taken into mind. Training with our brokers will show you the most important information to know, to the point that you can trade while you’re sipping on a coffee. Trading is not an unknown beast that nobody knows how to handle. Today it can be a much more casual activity, something you make money with while being properly prepared.